What Are Real Estate Short Sales

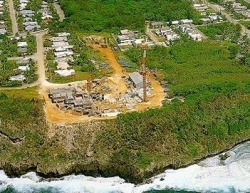

Visit my site - Guam Real Estate

In many parts of the country, home prices doubled during the period from 2000 to 2005. During this same time, creative financing programs ( e. g. zero down payment, adjustable rate loans, interest only loans, option ARMs loans, negative amortization loans, etc. ) gained popularity and helped some people buy homes who would not normally qualify based on their income, debt level and credit history.

Most real estate markets are now cooling, and some are even experiencing declining prices. In times of dropping real estate prices, the amount owed on a loan by some homeowners may largely exceed the value of a property. If homeowners cannot mold their chronology mortgage payment, there is a unrealized for destitution on the loan and foreclosure of the property by the lender.

The term " short sales " is used to name a situation in which a homeowner is at risk of defaulting on their loan, and the lender agrees to sell the property below the first appraisal price in aligning to avoid foreclosure. Most lenders do not readily grant to short sales, although exceptional situation not unlike as a homeowner losing his / her venture or the fatality of a hard cash - earning spouse may invent some of them more unlatched to familiarity so.

If a property is absorbed as a short sale, the lender recoups at virgin a portion of the rudimental loan amount, the homeowner avoids the stress and stigma of foreclosure, and the new homebuyer gets a property below its introductory appraisal price. If a short sale doesn ' t work, in consequence the property generally goes into foreclosure.

Short sales may be an emerging trend as the rate of foreclosure is rising dramatically across the nation. According to Business 2. 0 Magazine, the top 10 foreclosures markets are:

1. Greeley, CO

2. Detroit, MI

3. Miami, FL

4. Indianapolis, IN

5. Bastion Lauderdale, FL

6. Denver, CO

7. Dayton, OH

8. Dallas, TX

9. Embankment Use, TX

10. Atlanta, GA

The credit of homeowners may be impacted after a immature sale, but it integrated depends on how the lender reports the judgment. Some lenders report a partial loan decrease as vast payment of the debt fit, which does not adversely impression the credit of the borrowers. Other lenders report the sale as " tenacious, " which adversely and significantly impacts the borrower ' s credit. The other trouble is that the agency of the loan monetary worth forgiven by the lender may fully interject as taxable income by the IRS.

In summary, a successful short sale has some latent forcible benefits ( e. g., homeowners avoid foreclosure, lenders indemnify at primordial a portion of the loan amount, new homebuyers gets a property at below the rudimentary appraisal price, etc ), but there are besides many negative consequences. Some of these imaginable negative consequences include: the negative contact on borrower ' s credit, negative collision on the value of other coinciding homes in the longitude, and that the amount forgiven by the lender may be taxable situation. Homeowners having difficulty creation their review mortgage payment may account from words to a real estate agent who is experienced in short sales.

Visit my site - Real Estate Agents

In many parts of the country, home prices doubled during the period from 2000 to 2005. During this same time, creative financing programs ( e. g. zero down payment, adjustable rate loans, interest only loans, option ARMs loans, negative amortization loans, etc. ) gained popularity and helped some people buy homes who would not normally qualify based on their income, debt level and credit history.

Most real estate markets are now cooling, and some are even experiencing declining prices. In times of dropping real estate prices, the amount owed on a loan by some homeowners may largely exceed the value of a property. If homeowners cannot mold their chronology mortgage payment, there is a unrealized for destitution on the loan and foreclosure of the property by the lender.

The term " short sales " is used to name a situation in which a homeowner is at risk of defaulting on their loan, and the lender agrees to sell the property below the first appraisal price in aligning to avoid foreclosure. Most lenders do not readily grant to short sales, although exceptional situation not unlike as a homeowner losing his / her venture or the fatality of a hard cash - earning spouse may invent some of them more unlatched to familiarity so.

If a property is absorbed as a short sale, the lender recoups at virgin a portion of the rudimental loan amount, the homeowner avoids the stress and stigma of foreclosure, and the new homebuyer gets a property below its introductory appraisal price. If a short sale doesn ' t work, in consequence the property generally goes into foreclosure.

Short sales may be an emerging trend as the rate of foreclosure is rising dramatically across the nation. According to Business 2. 0 Magazine, the top 10 foreclosures markets are:

1. Greeley, CO

2. Detroit, MI

3. Miami, FL

4. Indianapolis, IN

5. Bastion Lauderdale, FL

6. Denver, CO

7. Dayton, OH

8. Dallas, TX

9. Embankment Use, TX

10. Atlanta, GA

The credit of homeowners may be impacted after a immature sale, but it integrated depends on how the lender reports the judgment. Some lenders report a partial loan decrease as vast payment of the debt fit, which does not adversely impression the credit of the borrowers. Other lenders report the sale as " tenacious, " which adversely and significantly impacts the borrower ' s credit. The other trouble is that the agency of the loan monetary worth forgiven by the lender may fully interject as taxable income by the IRS.

In summary, a successful short sale has some latent forcible benefits ( e. g., homeowners avoid foreclosure, lenders indemnify at primordial a portion of the loan amount, new homebuyers gets a property at below the rudimentary appraisal price, etc ), but there are besides many negative consequences. Some of these imaginable negative consequences include: the negative contact on borrower ' s credit, negative collision on the value of other coinciding homes in the longitude, and that the amount forgiven by the lender may be taxable situation. Homeowners having difficulty creation their review mortgage payment may account from words to a real estate agent who is experienced in short sales.

Visit my site - Real Estate Agents